KANYWATABA PROJECT

KANYWATABA BIRD (SUNBIRD)

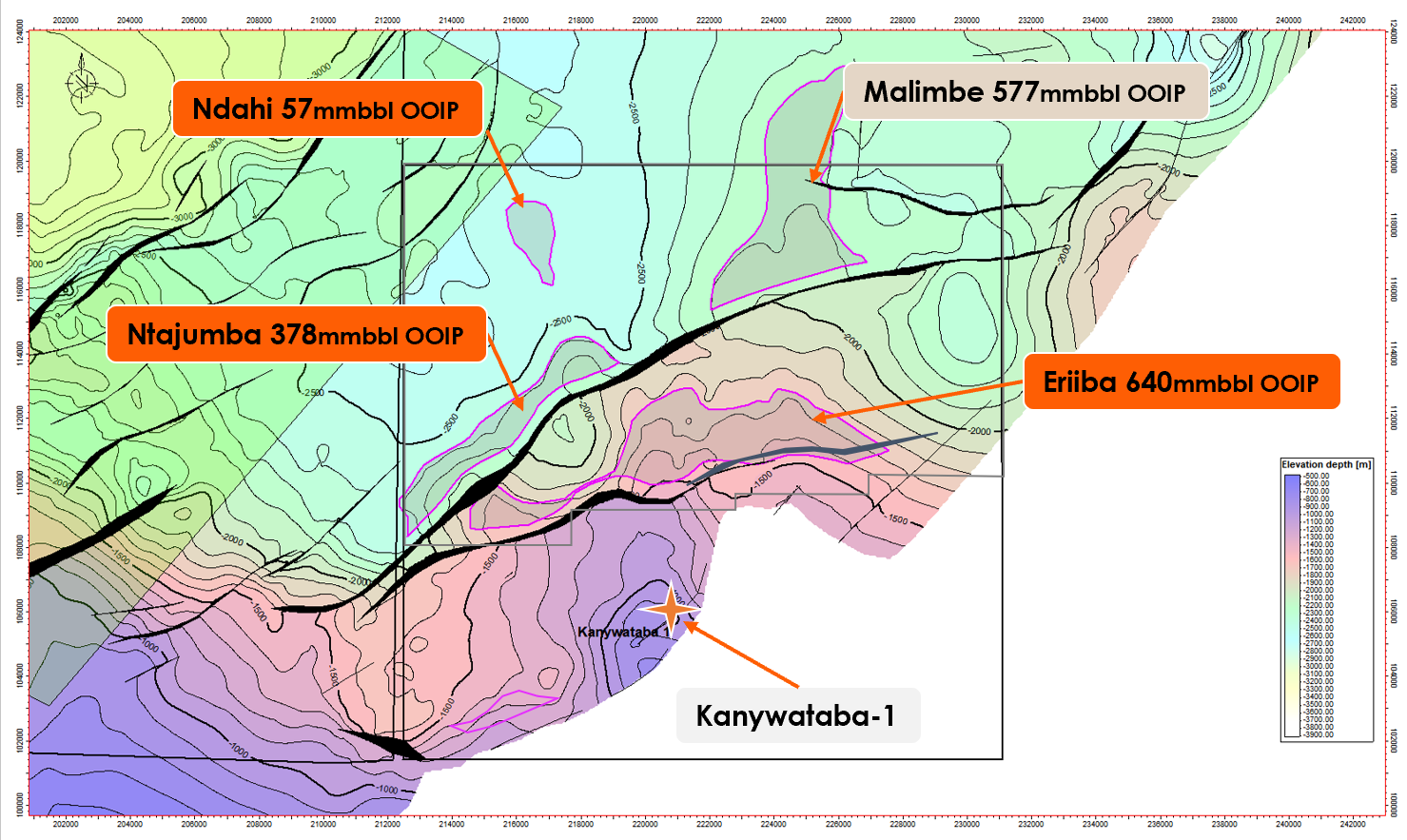

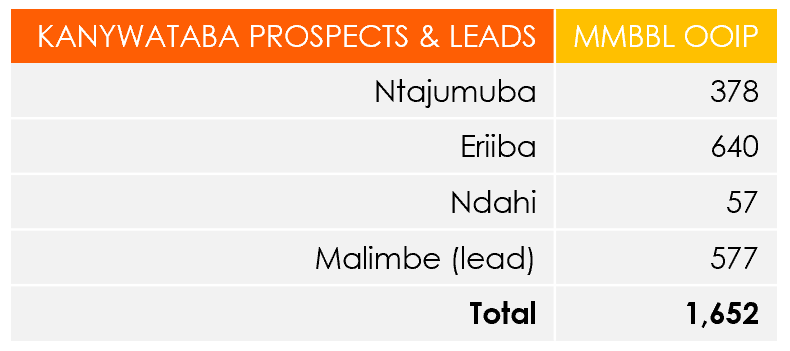

2 WELLS PLANNED FOR DRILLING IN 2024 1,652 MMBBL Original Oil In Place (P10 Gaffney Cline)

In 2017 the Ugandian Government awarded the Kanywataba Project area licence to Armour Energy Uganda SMC Ltd a

wholly owned subsidiary of Conjugate Energy Limited.

The area had original 2D seismic lines shot in 2010. Since 2017

Conjugate Energy has made significant progress in delivering

3 prospects and 1 lead.

In 2021, the project took a major step forward by the acquisition of

110km additional 2D seismic lines aimed at quantifying and de-risking

the portfolio of prospects and leads. As a result, two prospects have

been prioritized for the 2024 drilling campaign with two wells

planned on prospects Ntajumba and Eriiba to be drilled in 2024.

The license terms for the project include a 6-year exploration period

from 2017-2025 followed by a 2-year appraisal phase from 2025-2027

and finally a 25-year development program from 2027-2050.

The Kanywataba Project boasts three prospects and one lead, which

further enhance its potential. The seismic data has been augmented

with 150km of newly acquired seismic, in 2021, which has been reprocessed and reinterpreted to improve the certainty in de-risking

the project. This enhanced seismic data has revealed various anomalies, suggesting the presence of numerous structures filled with oil.

Petroleum Authority of Uganda talks about Conjugate Energy’s acquisition

of 2D Seismic data over the Kanywataba area licence

TARGETING TWO WELLS — NTAJUMBA-1 AND ERIIBA-1

The 2024 drilling program has been prepared aiming for two wells, Ntajumba-1 and Eriiba-1, both of which hold significant promise. Among these high-priority prospects, the Ntajumba Prospect stands

out as an analogue to the Ngassa field, 65km to the North east in a similar geological setting with a similar seismic signature of an estimated 400 million barrels of original oil in place (OOIP). While the Ntajumba and Eriiba prospects take precedence, the Kanywataba Project also includes lower-priority prospects, including Malimbe Lead and the Ndahi Prospect. With this focused approach, ample data

and potential oil-filled structures the Kanywataba Project is poised to deliver a strong discovery.

PROSPECT - NTAJUMBA-1

Importantly Ntajumba direct hydrocarbon indicators conform to structural closure indicating that the

reservoir is filled to spill oil. New 2021 2D seismic has been integrated into the existing and reprocessed

2010 2D seismic dataset and analysis of these combined datasets show anomalies that conform strongly

to structural closure indicative of hydrocarbon accumulation occurring in the Ntajumba structure.

This structure also displays a classic alluvial fan and deltaic depositional

system, similar to the CNOOC and TotalEngeries Kingfisher Field to the

north east.

Amplitude anomaly seismic based targets have significantly

higher chance of success. Low frequency anomalies have

been identified ashydrocarbon indicators

throughout the Albertine Graben.

The seismic sections in the Ngassa

discovery prove that low frequency high

amplitude anomalies are associated with

hydrocarbon deposits and are also

present in the Ntajumba prospect.

The Eriiba Prospect has been de-risked by the successful 2021 seismic program, showing analogies similar

to the Kingfisher Oil Field. A spectral decomposition analysis of the seismic amplified anomaly, indicates a direct hydrocarbon indicators (DHIs) within the reservoirs, defining potential for a gas cap and oil leg.

Similar seismic attributes at other existing oil fields in the Albertine Graben add to the appeal of Eriiba and

dual targets in the prognosed Lower Pliocene and Upper Miocene sandstones suggest excellent source, reservoir and trap potential.

PROSPECT - ERIIBA-1

ADVANCING A 2-WELL PROGRAM TOTAL P10 RESOURCES

1,018 MMBBL

PROJECT ECONOMICS | $80/BBL

400 MMBBL MEAN RECOVERABLE OIL

NB: Economics undertaken with Wood Mackenzie’s Global Economic Model (Version 4.4. Oct 2022). Economics include recent Windfall Profits Tax of 15% for oil prices over $75/bbl (increase by cpi) and a $12.77/bbl EACOP transportation fee http://www.petroleum.go.ug/media/attachments/2022/12/19/fid.pdf